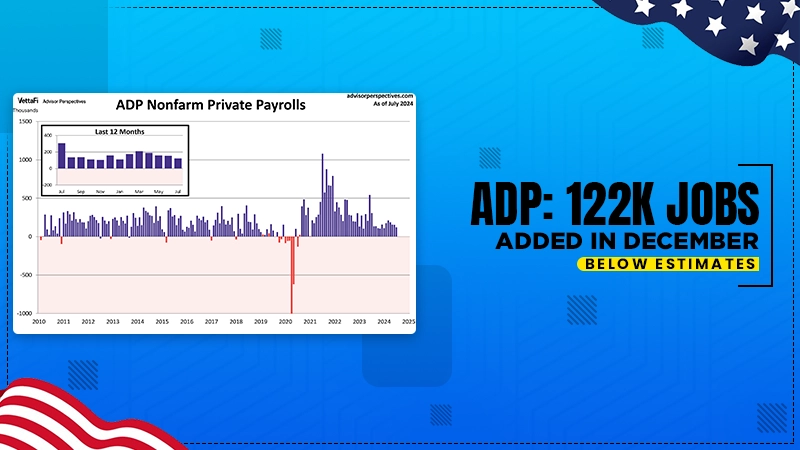

On Wednesday, it was reported by the ADP which is a payment processing company that the growth rate of private-sector jobs fell more than it was expected in December. This decline has been because of the salary growth reaching the lowest level in recent years.

Businesses have created 122,000 seasonally adjusted positions this month which is less than the total in November than the Dow Jones prediction of 136,000. This has been the smallest increase noted since August.

Additionally, wage growth has slowed, increasing 4.6% from the prior year which has been the weakest gain since July 2021. Nela Richardson, ADP’s chief economist stated, “The labor market experienced a shift to a more moderate growth rate in the last month of 2024, with both hiring and wage increases slowing down.”

There have been few indicators of an increase in layoffs, despite signs that hiring is reducing. On Wednesday, it was reported by the Labor Department that the initial unemployment issuance claims stood at just 201,000 for the week ending January 4. It has been the lowest number since February 2024 and much lower than the 215,000 expectation.

These reports came out just two days before the highly anticipated nonfarm payroll data by the Bureau of Labor Statistics. Economists polled by Dow Jones projected a growth of 155,000 jobs. It shows a notable drop from the very high number of 227,000 in November. The ADP and BLS figures often show major discrepancies.

Federal Reserve officials are closely connected to monitor these employment statistics as they consider their next monetary policy decisions. While most believe that the labor market remains strong, they aim to maintain less restrictive interest rates to support job growth.

In addition to this, they have also expressed increased confidence that inflation is stabilizing, even though it has remained above the 2% target of the Fed.

Subscribe to our newsletter and get top Tech, Gaming & Streaming latest news, updates and amazing offers delivered directly in your inbox.