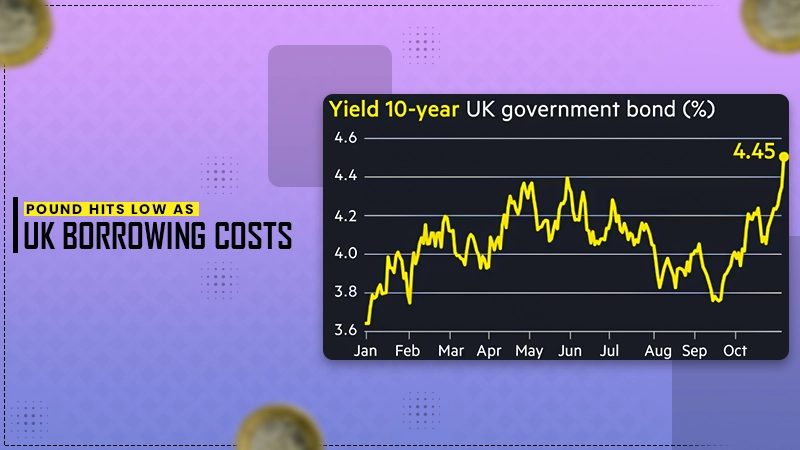

A drop in the pound to its lowest level in more than a year was noticed as borrowing prices in the UK have risen to their highest levels in 16 years. Concerns have been expressed by economists that these rising expenses might lead to further tax increases or reductions in the budget.

The increasing costs are because the government strives to adhere to its self-imposed guidelines of not borrowing for everyday expenses. In response to an urgent inquiry in the Commons, Treasury Minister Darren Jones focused that there was no need for an emergency intervention. He asserted that markets are still functioning in an orderly way.

However, shadow chancellor Mel Stride countered it mentioning, “The combination of higher debt and lower growth is understandably raising significant concerns among the public, businesses, and market players.”

Jones remarked, “It is typical for the prices and yields of gilts to fluctuate in response to broader movements in global financial markets, particularly in reaction to economic data.” He insisted on the fact that the government would only be borrowing for investment purposes.

In contrast to this, Stride argued, “The government’s decision to ramp up borrowing means that their own tax increases will ultimately be consumed by the rising borrowing costs, providing no advantage to the British populace.”

The pound dipped by 0.9% to $1.226 against the dollar on Thursday, while borrowing costs initially spiked but stabilized by mid-afternoon. Generally, the sterling appreciates when borrowing costs rise but economists noted that overarching concerns regarding the robustness of the UK economy have driven it downward.

The government generally usually spends more than it collects in taxes and to bridge this gap, it borrows money which must be repaid with interest. Also, one of the best methods of borrowing is through the sale of financial instruments known as bonds. The chief economic adviser at asset management firm Allianz shared with BBC that the increase in borrowing costs means the government will pay more in interest on its debt.

Subscribe to our newsletter and get top Tech, Gaming & Streaming latest news, updates and amazing offers delivered directly in your inbox.